In 2024, nominal wages in Singapore increased by about 3.2%, while software engineers’ salaries rose by 3.3%. This steady rise in pay has created cost pressure for many companies managing in-house development (Reuters, Singapore Global Network). At the same time, competition for local tech talent remains intense, driving longer hiring timelines and higher operational costs. To stay competitive, more Singaporean companies are turning to Asia’s leading IT outsourcing markets. These destinations offer mature talent ecosystems, competitive pricing, and flexible delivery models, which are clear strategic advantages for growth. (Precedence Research).

This article explores 5 key markets, highlighting their strengths, challenges, and critical factors to consider before making a decision.

IT Outsourcing in India: Software Engineering and IT Services at Global Scale

India is a global powerhouse for software engineering and IT services.

The country boasts a wealth of talent, mature delivery models, and robust digital infrastructure.

With a thriving developer ecosystem, India remains a top destination for IT outsourcing and offshore development worldwide.

Cost of IT Outsourcing in India

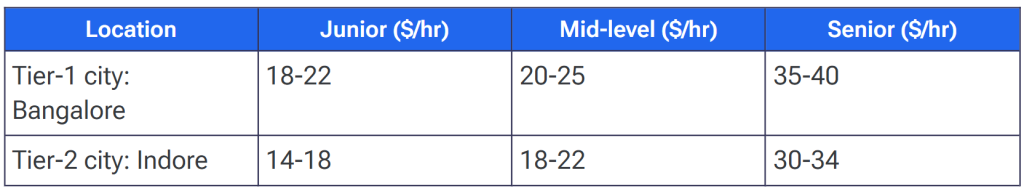

Hourly rates in India typically span USD $14–$40, depending on seniority, city, and specialization. However, rates can shift substantially when requirements tighten or technology is niche.

For example, a senior cloud architect in Bangalore charges around $38 per hour. That’s roughly 70% more than a junior full-stack graduate working in the same office.

Developers in Tier-1 metros such as Bangalore, Hyderabad, and Delhi earn 15–20% more than peers in emerging hubs. Fixed-price SOWs usually include a 4–6% buffer to cover currency and scope drift.

In contrast, time-and-materials models can expose clients to velocity risks when project requirements expand (Devico)

Time Zone Compatibility

India’s GMT+5:30 time zone is 2.5 hours behind Singapore, aligning well with Europe and making it ideal for handover models. However, this earlier time zone reduces overlap with East Asia. As a result, real-time coordination can be more challenging for certain offshore projects.

Human Resources and Talent Growth

India has one of the largest technology workforces in the world, with over 5.4 million IT professionals (NASSCOM). Moreover, India’s universities produce more than 2.6 million STEM graduates every year. This creates a solid foundation for engineering, QA, and specialized IT roles. (FDM Group).

Thanks to this deep talent pool, India remains one of the top destinations for IT outsourcing and offshore development, especially in enterprise and cloud engineering projects.

Communication and English Proficiency

With more than 125 million English speakers, India is the second-largest English-speaking country globally (BBC). This linguistic advantage enables smooth collaboration with international teams and clients.

However, accent clarity and cross-cultural nuances may require structured onboarding and alignment between distributed teams to ensure communication efficiency.

Facilities and Infrastructure

Tier-1 hubs such as Bengaluru, Hyderabad, Pune, and NCR host advanced delivery centers with strong connectivity and modern facilities.

That said, lower-tier cities may still face internet reliability and power challenges, potentially affecting remote teams’ performance (TMS Outsource).

Technical Skill Set and Innovation

India’s developer community is one of the fastest-growing in the world. It ranks second in open-source contributions and first in developer growth rate on GitHub (GitHub Octoverse). Capabilities are expanding rapidly in AI, cloud computing, data engineering, and enterprise software. In fact, the country now employs more than 420,000 professionals in AI roles (Reuters).

Political Environment and Culture

India’s government maintains a pro-IT and export-friendly policy, supporting innovation clusters and foreign investments. The nation has evolved from a low-cost outsourcing hub into a value-driven offshoring center. Today, it attracts global engineering teams and R&D investments. (Knight Frank)

IT Outsourcing in Philippines: Customer Support and BPO with Premier English Fluency

The Philippines is widely recognized as a leading Asian hub for IT outsourcing and BPO services. Its key advantages include strong English proficiency, close cultural alignment with Western and ASEAN clients, and cost-effective scalability across voice, IT helpdesk, and back-office operations.

Cost of IT Outsourcing in Philippines

Hourly rates in the Philippines typically range from USD $9–$45, giving companies a practical way to optimize operational costs. Many IT outsourcing providers in the Philippines report up to 70% savings in overhead and labor costs. This cost advantage makes the country an attractive choice for firms aiming to scale efficiently.

In the Philippines’ IT outsourcing sector, entry-level roles like data entry are cost-effective, while advanced positions in software development and IT support require a higher investment. For instance, technical support outsourcing usually costs between $9/hour and $25/hour (Unity Communication).

Time Zone Compatibility

Operating on GMT+8, the Philippines shares the same time zone as Singapore, enabling seamless real-time collaboration across ASEAN markets. Companies with clients in Europe or North America may need to adopt extended hours or shifts for effective communication and delivery.

Human Resources and Talent Growth

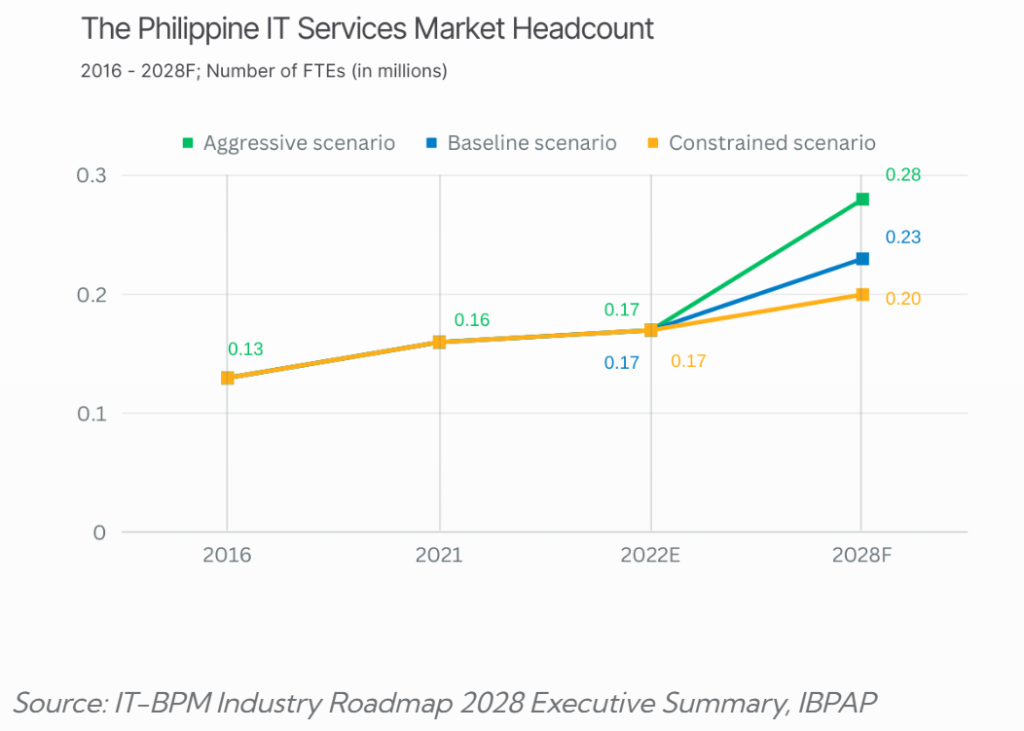

The IT-BPM industry in the Philippines now employs over 1.57 million people. In 2022 alone, the sector added 121,000 new jobs, an 8.4% annual increase.

Employment in IT services is expected to increase from 170,000 in 2022 to 230,000-280,000 by 2028. This growth highlights a clear shift from basic BPO roles toward more technical and specialized IT functions. (IBPAP, Unity Communications).

Universities and private training institutions are creating a young, English-proficient talent pool to meet the rising global demand for offshore IT outsourcing and digital transformation.

Communication and English Proficiency

One of the Philippines’ biggest advantages is its strong English fluency. The country ranked 22nd out of 116 in the 2024 EF English Proficiency Index with a score of 570, indicating “High Proficiency”(EF EPI)

Similarly, the Pearson Global English Proficiency Report 2024 found that Filipino corporate employees scored above the global average in both speaking and writing skills (PR Newswire). Combined with a 96.6% literacy rate (Unity Communication), Filipino professionals can communicate effectively with international clients like Singapore, reducing barriers in collaboration.

Facilities and Infrastructure

Major outsourcing hubs like Manila, Cebu, and Clark offer modern BPO infrastructure with high-speed internet, stable power, and facilities that support 24/7 global delivery. These business districts have attracted global firms and significant infrastructure investment (TDSGS).

Most top-tier buildings in Metro Manila have backup generators, redundant fiber internet lines, and UPS systems for business continuity, unlike smaller provincial cities. (Outsource Accelerator).

Technical Skill Set and Innovation

The Philippines is steadily moving up the value chain, from traditional voice-based support to higher-value IT and digital services. Outsourcing companies now offer advanced IT solutions like helpdesk support, infrastructure monitoring, and software assistance. (Unity Connect).

The local IT-BPM industry is heavily investing in cybersecurity, data analytics, AI support, and cloud operations due to increased international demand for these skills (Reuters). This evolution positions Filipino IT professionals as valuable contributors to end-to-end technology service delivery.

Political Environment and Culture

The Philippine government actively promotes the IT-BPM sector through tax incentives, investment zones, and training initiatives. Under the CREATE MORE law, outsourcing firms can enjoy corporate tax rates as low as 20%, ensuring cost competitiveness (DV Philippines).

In 2025, the government allocated ₱740 million to upskill the IT and BPO workforce in AI, cloud computing, and data analytics, boosting the Philippines’ global outsourcing position. (People Matters Global).

IT Outsourcing in Vietnam: Best-Cost Hub for Software Development and Digital Services

Vietnam is a cost-competitive IT outsourcing destination in Asia, offering low developer rates, skilled talent, and proximity to Singapore. Its pricing advantage and stable infrastructure make it an appealing choice for software development and digital services.

Cost of IT Outsourcing in Vietnam

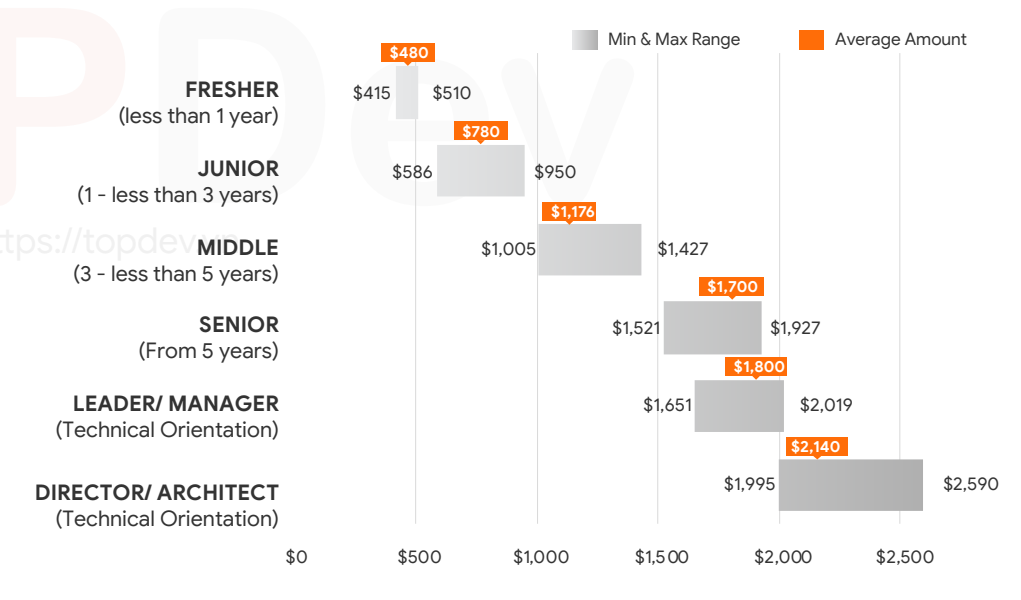

Hourly rates in Vietnam range from USD $3–$12, making it a cost-effective choice for software development in Asia (inferred from TopDev).

Rates in developed cities like Ho Chi Minh City and Hanoi are 10–25% higher on average, with tier-2 cities like Da Nang following. Salaries in less developed areas can be 25–30% lower. (inferred from Statista), creating further room for cost optimization in large-scale delivery models.

Despite a lower cost structure, the country has strong technical capacity, with Ho Chi Minh City ranking among the top 100 cities globally in tech industries like Fintech, Edtech, E-commerce, and Transportation.(TopDev). This pricing advantage enables international companies to scale engineering teams cost-effectively without sacrificing quality, especially for long-term product development and offshore delivery centers.

Time Zone Compatability

GMT+7, just an hour behind Singapore, strikes a good balance. It supports regional collaboration and some EU overlap, but US coverage often requires night or split shifts.

Human Resources and Talent Growth

Vietnam’s digital workforce is large and expanding. Government figures indicate the broader ICT sector employs around 1.26 million people as of late 2024, reflecting steady year-over-year growth in digital enterprises (Vietnam News Magazine). Within that, the software and IT talent pool is sizable: recent market studies drawing on university and industry data estimate about 560,000 professionals in computer science and IT-related roles, with 55,000–60,000 new IT graduates each year feeding the pipeline (ISB Vietnam).

The workforce is also skewed toward junior and mid-level talent, which makes up 64% of the IT labor force in 2024 (TopDev). This structure reflects Vietnam’s young and fast-developing talent base, offering a strong pipeline for companies looking to scale engineering teams and develop future technical leaders.

Communication and English Proficiency

Vietnam ranks 63rd globally (score: 498) and 8th in Asia for English proficiency, categorized in the “Moderate Proficiency” band (EF EPI). Vietnam’s workforce has room for improvement in English compared to other SEA nations like Malaysia and the Philippines.

However, urban talent pools show stronger skills, averaging a score of 521, which helps in communicating with English-speaking clients, especially in Singapore and regional hubs.

Facilities and Infrastructure

Vietnam’s credibility as a tech infrastructure hub is rising fast. The government estimates the country’s rare-earth element reserves at about 22 million tons, among the largest in the world (Research and Markets). REEs are vital for high-tech sectors like semiconductors and renewable energy, positioning Vietnam as a strategic alternative to China in global technology and supply chains.

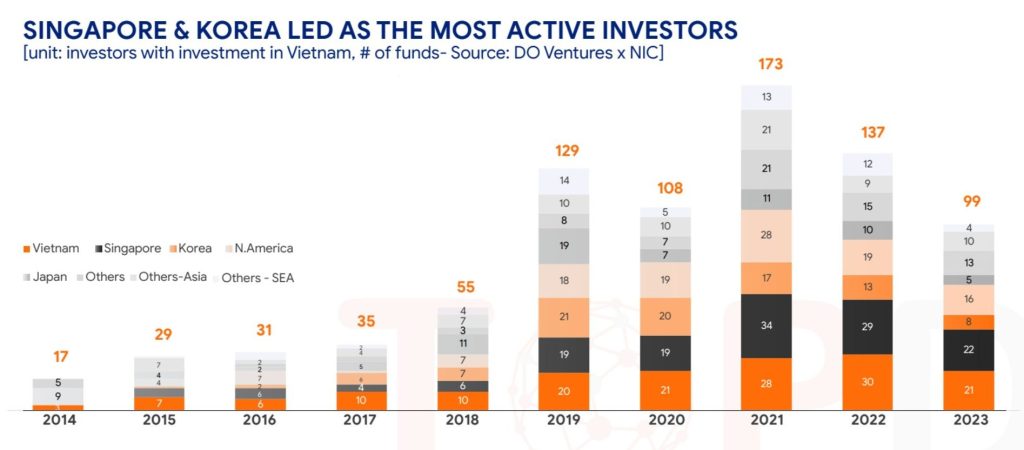

This edge is already drawing big players. NVIDIA will open an AI R&D and data center, while Google plans a hyperscale data center and will set up a local office in 2025 (NVIDIA, Reuters). Notably, Singapore leads as the most active investor in Vietnam’s tech sector (TopDev), reinforcing strong confidence in the country’s strategic resources and infrastructure.

Technical Skill Set and Innovation

Vietnam is particularly strong in AI/ML engineering and cloud-native roles. The country hosts 765+ AI and ML startups, ranking 2nd in Southeast Asia (VnEconomy). Its cloud AI market was valued at USD 436 million in 2024 and is projected to grow at 37% CAGR through 2033 (IMARC Group). The country also ranks top 2 globally for developer freelancing competency (TopDev), reflecting strong technical capabilities and global competitiveness.

Political Environment and Culture

Vietnam is boosting support for its tech sector with tax incentives, R&D subsidies, and PPP frameworks to attract private investment (Vietnam Briefing).

The new Digital Technology Law, effective 2026, provides tax breaks and land rent exemptions for tech firms and startups to promote domestic innovation over outsourcing (Vietnam Law Magazine).

IT Outsourcing in Malaysia: Stable Mid-Market with Skilled Multilingual Talent

Malaysia stands out as a strategic, business-friendly hub in Asia, combining cost efficiency, English–Chinese bilingual talent, and a rapidly expanding cloud infrastructure. Its strong alignment with Singapore positions it as a natural bridge for companies seeking stable, scalable delivery in the region.

Cost of IT Outsourcing in Malaysia

Malaysia sits in the mid-tier cost bracket in Asia, offering solid technical talent without premium price tags. According to Michael Page’s 2025 Salary Guide, software engineers earn around USD $28,400 per year (around USD $2,366/month), while JobStreet listings show USD $1,017–$1,491/month.

This works out to roughly USD $5–$12 per hour, depending on role and location. Developed local hubs like Kuala Lumpur typically falls on the higher end, while other cities offer more cost efficiency. This balanced pricing makes Malaysia an increasingly attractive IT outsourcing destination.

Time Zone Compatibility

Malaysia runs on GMT+8 year round with no daylight saving, the same as Singapore. This allows smooth overlap with East Asia and Australia, good morning to midday coverage with Europe, and workable early morning or late evening windows with North America. It is a convenient time zone for collaboration across APAC and Europe.

Human Resources and Talent Growth

Malaysia’s ICT workforce is expanding steadily, reaching 1.24 million employees in 2023 (Department of Statistics Malaysis). The country has a strong graduate pipeline, with millions entering skilled occupations each year, including engineering, data, and ICT talent. This is supported by leading institutions such as Universiti Malaya (ranked 58th in the 2025 QS World University Rankings) and Universiti Teknologi Malaysia.

Digital talent demand is also rising, with thousands of new openings each quarter and increasing investment activity in Greater Kuala Lumpur. This steady growth is strengthening Malaysia’s position as a reliable regional talent hub.

Communication and English Proficiency

Strong multilingual capabilities in Malaysia give the workforce a natural edge in collaborating with Singaporean companies. The country ranks 26th globally and among the top three in Asia in 2024 (EF EPI), with Kuala Lumpur classified as “high proficiency.”

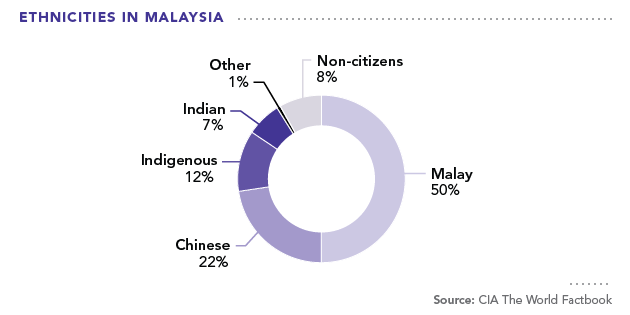

English is widely used in business, and many professionals are bilingual or trilingual, combining English with Malay, Mandarin, Cantonese, or Tamil (APF, ResearchGate). This multilingual environment closely mirrors Singapore’s linguistic and cultural mix, enabling Malaysian teams to collaborate seamlessly with Singaporean counterparts. The strong language and cultural overlap minimizes communication barriers and supports smooth cross-border operations.

Facilities and Infrastructure

Enterprise infrastructure is improving fast. Amazon Web Services opened its Malaysia cloud region in August 2024 (AWS), and Microsoft is rolling out its first cloud region with three data centers (Reuters). This complements Google’s US$2 billion investment to build a data center and launch a Google Cloud region with sovereign-cloud capabilities through Dagang NeXchange Berhad (Reuters).

Johor and Greater Kuala Lumpur – Malaysia’s most developed cities, are also emerging as Southeast Asia data center hot spots, backed by a robust pipeline of under-construction facilities (Reuters). Together, these developments signal a rapidly strengthening digital infrastructure backbone that supports large-scale enterprise operations and cross-border delivery.

Technical Skill Set and Innovation

The tech workforce is broad and increasingly cloud/AI-oriented. In Q3 2024, MDEC’s Digital Talent Snapshot revealed 357,414 digital professionals on LinkedIn and 92,324 open roles, with high demand for skills in data engineering, software development, cybersecurity, and AI.

Partnerships like the AWS Skills to Jobs Tech Alliance are enhancing the talent pipeline for cloud computing and analytics. (MDEC).

Political Environment and Culture

Malaysia offers a stable and predictable environment for long-term partnerships. It ranks 13th globally in the 2025 Global Peace Index, sits near the 80th percentile for World Bank Government Effectiveness, and scores 50/100 on the 2024 Transparency International CPI (Transparency International Malaysia, Global Peace Index).

Workplaces are multicultural, reflecting Malay, Chinese, and Indian traditions, with a diverse holiday calendar. For companies in the region, especially from Singapore, the IT outsourcing environment is familiar and easy to navigate.

IT Outsourcing in China: Manufacturing-Tech Giant with Massive Scale

Taiwan and China, renowned for their advanced technology expertise, stand as formidable players in the IT outsourcing arena. It’s important to consider costs and factors to see if they align with your business goals.

Cost of IT Outsourcing in China

China’s IT talent market sits in the mid-to-upper range for Asia, with clear cost gaps by city tier. Average software engineer compensation is around USD $56,000/year (roughly USD $27/hour), rising to USD $60,000–$65,000 (USD $29–$31/hour) in Tier-1 cities like Shanghai and Shenzhen, and lower in interior cities (inferred from ERI).

Vendors often combine Tier-1 specialists with Tier-2 delivery teams, where salary is typically 40-60% lower (SecondTalent). This gives buyers more flexibility to scale while keeping overall delivery costs competitive.

Time Zone Compatibility

GMT+8, the same as Singapore and Malaysia, supports smooth regional collaboration, good overlap with Europe, and workable early morning or late evening windows with North America.

Human Resources and Talent Growth

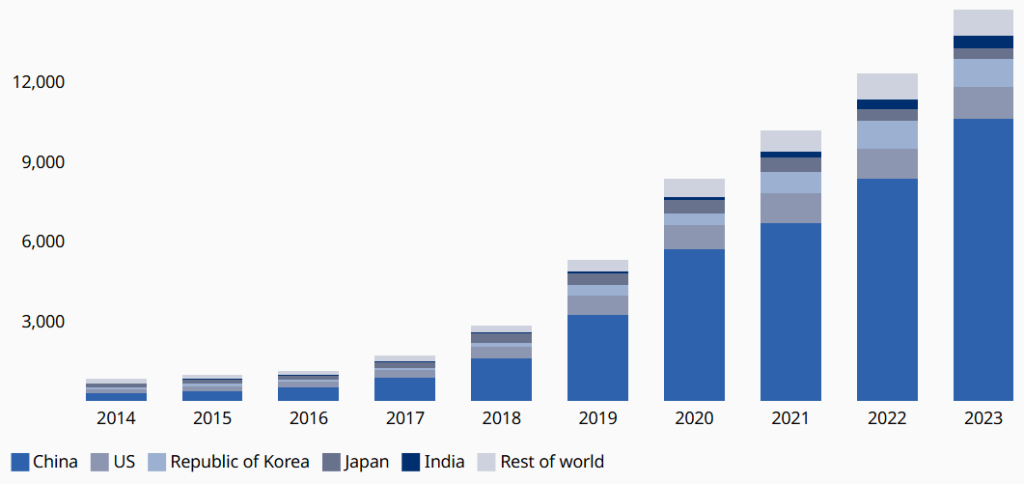

China’s tech talent pool is both large and highly specialized, shaped by its strong manufacturing base. As the world’s largest industrial-robot market, it added more than 295,000 new units in 2024, bringing its total stock to over 2 million (IFR). This reflects deep expertise in embedded systems and automation. Meanwhile, the software and IT services sector is expanding at double-digit rates year-on-year, building a strong foundation for large-scale outsourcing delivery (China Daily).

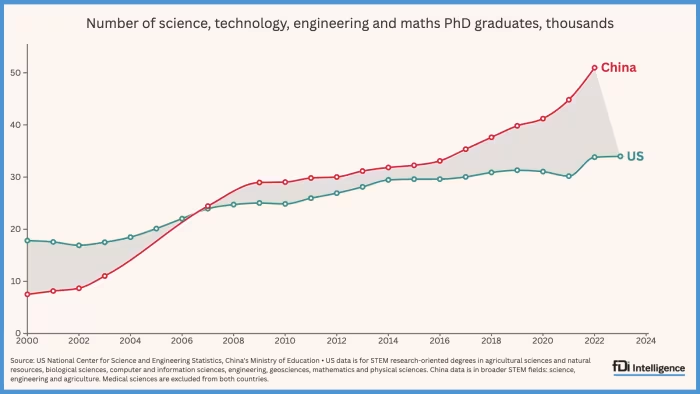

China is among the top ten in the Global Innovation Index and leads global AI patenting, with around 70% of AI patents granted in 2023 (Artificial Intelligence Index Report 2025). R&D spending at 2.68% of GDP in 2024 and over 50,000 annual STEM PhD graduates ensure a strong talent pipeline for complex, tech-intensive projects (State Council of the People’s Republic of China, FDI Intelligence) .

China and India lead among the five countries in talent scale and technical depth, albeit at a higher cost than Malaysia, Vietnam, and the Philippines.

Communication and English Proficiency

Mandarin is still the main working language across most delivery teams. English proficiency is improving in major hubs but remains less developed compared with India, the Philippines, Malaysia, and Vietnam. China ranks 91st out of 116 countries in EF’s 2024 English Proficiency Index, with a score of 455, indicating “low proficiency.” (EF EPI). English levels are stronger in Tier-1 cities, where many international companies are based.

Outsourcing often relies on client-facing English in Tier-1 hubs, where higher pay rates can challenge cost-efficient scaling for companies. However, on the bright side, China’s alignment with Singapore’s GMT+8 time zone supports real-time collaboration. Bilingual project managers and structured communication workflows can enhance cross-border delivery and improve coordination with Singaporean companies.

Facilities and Infrastructure

China has invested over USD $6 billion in the past two years in Tier-1 hubs like Beijing, Shanghai, and Shenzhen, enhancing their connectivity, data centers, and power systems for large-scale deliver (Reuters).

The government is promoting the “Eastern Data, Western Computing” program to encourage companies to set up data centers in inland provinces with lower energy and land costs (The Jamestown Foundation). The goal is to ease pressure on crowded coastal hubs and balance national computing capacity. Quality and reliability are concentrated in Tier-1 regions, which have more stable and better-equipped facilities for IT outsourcing.

Technical Skill Set and Innovation

China is particularly strong where software meets hardware, from embedded systems and device firmware to IoT, computer vision, robotics control, and manufacturing execution.

Major tech hubs like Shenzhen, Suzhou, and the Yangtze River Delta host over 210 AI robotics companies, supported by significant investment in advanced industrial clusters. (China Daily, People’s Daily Online). The country is also emerging as a global leader in generative AI, accounting for roughly 70 % of GenAI patent filings worldwide (WIPO).

On the platform side, Chinese vendors have deep capabilities in fintech, e-commerce, logistics, and super-app ecosystems. Platforms like WeChat, Meituan, and Alipay operate at massive scale, serving hundreds of millions of users and driving the development of powerful infrastructure for payments, transactions, and real-time services (APF Canada).

Political Environment and Culture

China’s 2024 easing of cross-border data transfer rules has made compliance less burdensome for routine business flows, lowering filing thresholds and extending approvals to three years (White & Case). However, many Western SaaS tools are restricted or blocked, so Singaporean companies need localized or private collaboration stacks when working with Chinese vendors (Eastora Group). This combination of simplified compliance and localized delivery requirements means firms must plan carefully for tooling and regulatory alignment to ensure smooth outsourcing operations.

Picking the Right IT Outsourcing Market for Your Business Needs

| Criteria | Vietnam | India | Philippines | Malaysia | China |

|---|---|---|---|---|---|

| Cost | Low | Mid | Low–Mid | Mid | Mid–High |

| Time Zone vs SG | GMT+7 | GMT+5:30 | GMT+8 | GMT+8 | GMT+8 |

| Communication | Moderate overall, stronger in major cities | High, experienced in global delivery | High | High, multilingual | Low–Moderate overall, stronger in Tier-1 |

| Talent Scale & Focus | Large and growing, strong in AI/ML and cloud | Very large, across cloud, data, enterprise | Strong in IT services and support | Broad ICT workforce, rising AI capability | Very large, strong in software + hardware |

| Typical Strengths | Best cost, strong for product engineering and team scaling | Enterprise programs, data/cloud scale, fast ramp | 24×7 IT support, helpdesk, ops-heavy services | Balanced cost–quality, bilingual delivery | Embedded systems, robotics, large platforms |

| Key Watch-outs | English gaps outside Tier-1 cities; junior-heavy teams | Coordination overhead, variable vendor quality | Limited senior depth for niche stacks | Slightly higher cost for similar roles | Language barriers, compliance considerations |

Making the Choice

- If you value cost efficiency and proximity, Vietnam stands out.

- If your priority is scale and complex builds, India may suit best.

- If strong English communication and support work are key, Philippines is compelling.

- If you need balanced delivery with good governance, Malaysia is reliable.

- If your roadmap includes hardware or embedded systems, China deserves consideration.

Each country has clear strengths and trade-offs. Consider your project’s complexity, communication needs, governance capacity, and growth strategy carefully before making your decision.

Looking for an IT Outsourcing Provider?

LinkTree Corp is a trusted name in providing exceptional RaaS solutions to IT companies throughout Singapore. If you’re experiencing talent shortages or require flexible staffing for your projects, we’re here to help. Fill out our enquiry form for a tailored solution that perfectly aligns with your business needs.

Connect Now!